A strategic vulnerability: U.S. warns Taiwan’s chip dominance poses “apocalyptic” economic risk

- U.S. Treasury Secretary Scott Bessent warns that global reliance on Taiwan for advanced semiconductors is the world’s “single biggest point of failure.”

- He stated a blockade or destruction of Taiwan’s chip capacity would cause an “economic apocalypse.”

- The Trump administration is accelerating efforts to reshore semiconductor and critical mineral supply chains to the U.S.

- A new “critical minerals block” with G7 and other allied nations aims to break China’s dominance in essential resources.

- Bessent called on major U.S. defense contractors to prioritize building domestic factories over shareholder returns.

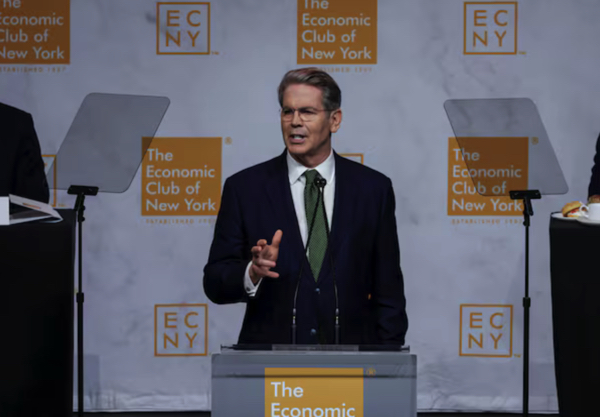

In a stark assessment of global economic fragility, U.S. Treasury Secretary Scott Bessent declared the world’s overwhelming reliance on Taiwan for advanced semiconductors its most dangerous systemic vulnerability. Speaking at the World Economic Forum in Davos, Switzerland, on Jan. 20, Bessent warned that any major disruption to the island’s manufacturing—such as a blockade or destruction in a conflict—would trigger an “economic apocalypse.” This warning underscores the Trump administration’s intensified push to reshore critical supply chains, moving production of vital technologies and minerals away from geopolitical adversaries and onto American soil.

The “single biggest point of failure”

Bessent framed the concentration of chip manufacturing as an unprecedented risk. “I would say that the single biggest threat to the world economy, the single biggest point of… failure is that 97 percent of the high-end chips are made in Taiwan,” he stated. His comments reflect a long-standing, bipartisan concern in Washington that has reached a new urgency amid heightened tensions between China and Taiwan. The administration views reducing this dependency as a non-negotiable priority for both national security and economic stability, akin to safeguarding the financial system. Bessent confirmed the U.S. is actively working with defense contractors to reshore the semiconductor industry, treating it as a mission-critical endeavor.

A mandate for defense industrial investment

In a notable shift in policy rhetoric, Bessent directly challenged major U.S. defense contractors, comparing them to systemically important banks that receive federal backstops to prevent broader collapse. He argued that, having benefited from government support, these contractors have a reciprocal duty to bolster domestic industrial capacity. Bessent accused them of lagging years behind on contracts and prioritizing stock buybacks over strategic investment. “They have let down the American people,” he said, asserting it was reasonable to direct them to “build more factories and buy back less stock” until further notice. This stance signals a more interventionist industrial policy aimed at compelling private sector alignment with national strategic goals.

From pandemic warning to allied action

Secretary Bessent pointed to the COVID-19 pandemic’s supply chain shocks as a formative “test run” for the catastrophic disruption a kinetic war could cause. That experience crystallized the need to secure about half a dozen key industries, with semiconductors and rare earth magnets at the top of the list. To counter China’s dominance in critical minerals—a leverage point Beijing has previously weaponized—the Treasury is helping orchestrate a new “critical minerals block.” This coalition, involving the G7 nations plus Australia, India, Mexico and South Korea, aims to create an allied supply chain for mining, processing and refining. “We are working at warp speed… so China won’t have this sword over our heads,” Bessent explained. He estimated the U.S. could achieve independence in refining key minerals within 18 to 24 months, citing new rare-earth magnet production in South Carolina as early progress.

A long-term strategic recalibration to secure the foundations of economic power

Bessent’s Davos warnings are not isolated but part of a broader, persistent campaign to mitigate what U.S. strategists call “weaponized interdependence.” The recent announcement of a major U.S.-Taiwan chips deal to expand American manufacturing investment further illustrates the tangible steps being taken. Historically, the offshoring of advanced manufacturing was driven by cost efficiency, but current policy marks a decisive pivot where resilience and security are now paramount cost factors. The administration’s dual approach—using carrots like allied partnerships and sticks like directives to defense contractors—highlights the comprehensive nature of the challenge. As geopolitical fault lines harden, the effort to rewire the global supply chain for foundational technologies is emerging as a defining feature of 21st-century economic statecraft, with profound implications for international alliances and the future balance of technological power.

Sources for this article include:

TheEpochTimes.com

FastBull.com

aa.com.tr

Read full article here