This article was originally published by Tyler Durden at ZeroHedge.

Late last week, the CEO of Flexport – one of the largest US supply-chain logistics operators – warned that “the biggest wild card in the presidential election that nobody’s talking about? The looming port strike that could shut down all East and Gulf Coast ports just 36 days before the election.”

The biggest wild card in the presidential election that nobody’s talking about? The looming port strike that could shut down all East and Gulf Coast ports just 36 days before the election. 🧵

— Ryan Petersen (@typesfast) September 18, 2024

With just over a week to go until D-Day, authorities are gearing up as a threatened strike by dockworkers at ports along the East Coast and Gulf Coast draws closer.

The Port Authority of New York and New Jersey is “coordinating with partners across the supply chain to prepare for any impacts” from a possible work stoppage by workers represented by the International Longshoremen’s Association as they negotiate with the United States Maritime Alliance (USMX), a Port Authority spokesperson told CBS MoneyWatch on Friday.

“We urge both sides to find common ground and keep the cargo flowing for the good of the national economy,” added the spokesperson, noting that $240 billion in goods move through the two ports each year and that such trade supports more than 600,000 local jobs.

According to the union, a strike would affect ports from Maine to Texas, and cripple supply chains worse than the immediate aftermath of the covid shutdown. A stoppage – the first since 1977 – could involve up to 45,000 workers at ports that account for roughly 60% of U.S. shipping traffic, leading to a major disruption of shipments, Oxford Economics said in a report.

“Even a two-week strike could disrupt supply chains until 2025,” Grace Zwemmer, associate U.S. economist with Oxford, said in the report.

As Rabobank’s Michael Every adds, “US businesses could miss the key Black Friday/Cyber Monday peak sales period. Port trade is around $2.12trn, and 72% would grind to a halt, a one-day strike reportedly taking six days to recover from, a one-week strike in October creating bottlenecks until mid-November, not factoring in Red Sea disruptions caused by the not-terrorist Houthis.”

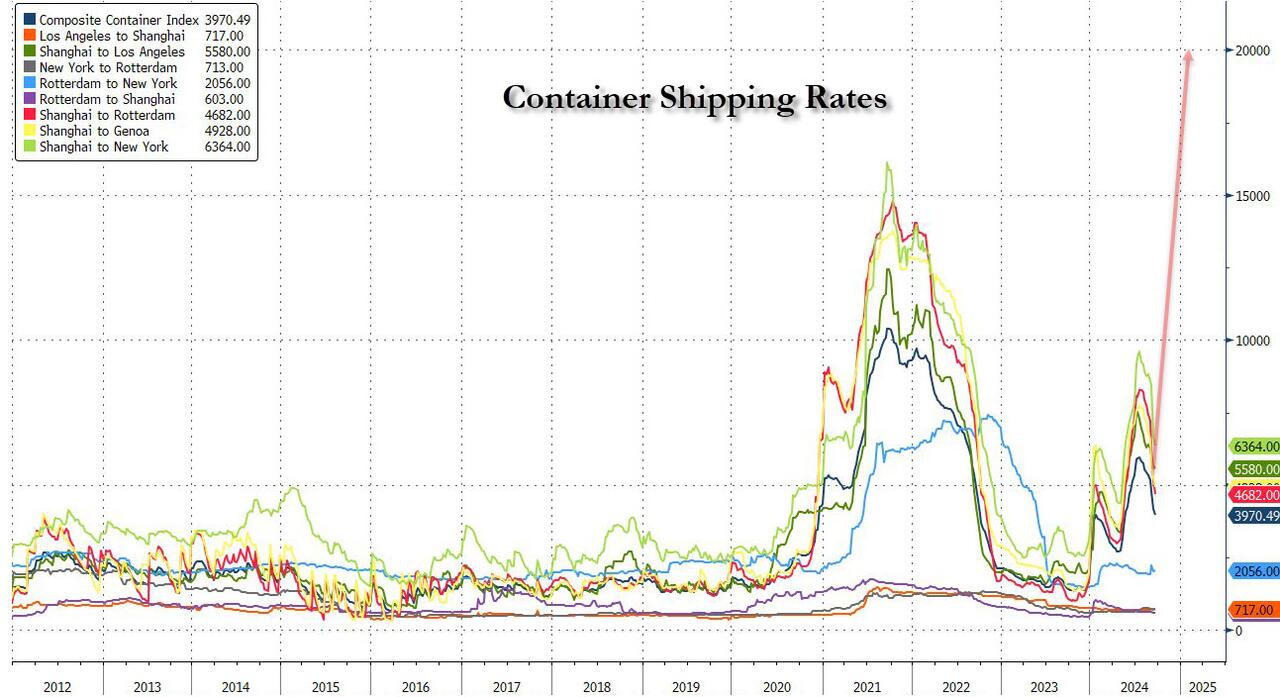

If goods are then forced to shift to the US West Coast ports, Rabobank speculates that Asia-US freight rates could leap to $20,000, far above the peak seen in the last supply-chain crisis. That would mean firms with low margins might opt not to import at all, creating empty shelves.

The ILA has threatened to strike if a new labor agreement with the East Coast port terminal and shipping companies represented by the USMX is not reached by the time the current contract expires on October 1. Although the sides continue to negotiate, the odds of a rare strike that threatens to shut down some of the nation’s busiest ports are rising.

“There will be a shutdown, assuming that there’s is no intervention, at midnight on Monday the 30th,” Bethann Rooney, director of the Port Authority of New York and New Jersey, the nation’s second-busiest port, told a briefing earlier in the week.

Should that occur, all activity loading and unloading cargo containers and automobiles would come to a standstill, while cruise ships would continue to operate, Rooney said.

The Port Authority isn’t involved in the bargaining between the ILA and USMX but rather leases space at the ports to shipping companies. Terminal operators and ocean carriers are “working to bring in as many ships as possible” ahead of a potential walkout, said Rooney.

Those steps include “working with truckers and the rail carriers to get as much cargo out as humanly possible, as quickly as possible,” the port director said.

The two ports are currently unloading about 20 large container ships a week, and they expect 150,000 containers to be unloaded ahead of the strike deadline, Rooney said.

“At the same time, ocean carriers are beginning to put essentially embargoes on export cargo “so that it doesn’t come into East and Gulf coast ports and then wind up sitting there,” she said.

Container ships carrying imports bound for Newark and Elizabeth in New Jersey and Staten Island in New York City will end up moored at specified spots in New York Harbor or off the coast during the strike, or remain at sea until they can come in. The Coast Guard and U.S. Customs and Border Protection would oversee arriving ships at the port facilities once a strike was over.

The ILA union walked away from the bargaining table in June, declaring that a type of automation introduced at the Port of Mobile in Alabama was in violation of the current contract.

Based in North Bergen, New Jersey, the ILA represents 85,000 workers across the East and Gulf Coasts. The union is demanding sizable wage increases for its members as well as protection from “job-killing” automation.

The USMX has said it has not been able to schedule new bargaining sessions with the union.

“It is disappointing that we have reached this point where the ILA is unwilling to reopen dialogue unless all of its demands are met,” USMX said on Tuesday in an update. “The only way to resolve this impasse is to resume negotiations, which we are willing to do at any time.”

While the Taft-Hartley Act gives the president the power to impose an 80-day cooling-off period to delay a strike, Biden has said he doesn’t intend to use it here given the impact doing so could have on union votes; although with the Teamsters refusing to endorse Kamala despite the union’s traditional Democrat support (as the majority of its members polled back Trump) that may be a moot point.

On the other hand, Every warns that the kind of strike described above would likely cripple Harris’ chances come 5 November.

Read full article here